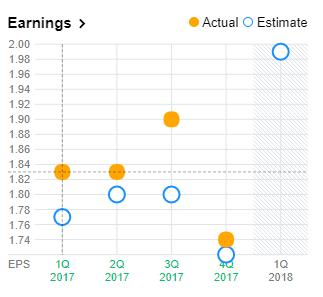

Johnson & Johnson (NYSE: JNJ), the global healthcare behemoth, posted Q4 2017 revenue of $20.2bn (an increase of 11.5%) and 2017 full-year earnings of $76.5bn (an increase of 6.3%) on January 23, 2018. Diluted loss per share was $3.99 (adjusted diluted EPS was $1.74 which was an increase of 10.1% compared to Q4 2016); while diluted EPS for 2017 full-year was $0.47 (adjusted diluted EPS was $7.36 which was an increase of 8.5%). The decrease was primarily due to the provisional charge of $13.6bn which was incurred due to the Republican tax reform. Free cash flow in 2017 was $17.8bn.

Exceeding the expectations set at the beginning of 2017, Johnson & Johnson also gave a total shareholder return of 24% with its Pharmaceutical business and Medical Device business showing great strengths. During 2017, it completed around 60 acquisitions and invested $10.5bn in R&D and $35bn in Mergers & Acquisitions. It also executed four divestitures as a part of its business fortification strategy.

Investment Outlook

As the above chart shows, the J&J stock rallied to all-time highs of $147 in January 2018 before falling down 13% to around $127 in March 2018. It went to its highs during 2017 due to its product launches, positive clinical data, and strong Q3 2017 results. However, it declined by 13% in February 2018 due to the following reasons:

- Q4 2017 results showed negative earnings due to the tax reform act

- Sales decline in some of its drugs, baby care division, and specialty surgery

- Talcum powder lawsuits since last year

As per the latest survey by Reuters, J&J stock has received a ‘buy’ or ‘strong buy’ rating from 52% of its analysts and a ‘hold’ rating from 35% of them.

However, looking toward 2018, Johnson & Johnson stock can be seen as a good investment for prospective shareholders due to the following reasons:

- With $10.5bn investment in Research & Development, J&J would also be tapping on the developing markets across the world.

- J&J’s forward price to earnings ratio is 18.5, lesser than the S&P 500 stock ratio, which makes it a good quality buy.

- With a presence in over 60 countries and a massive healthcare division, J&J is uniquely positioned to gain from economies of scale.

Dividend Outlook

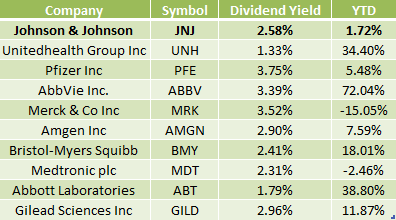

As a Dividend Aristocrat, J&J has raised its dividend for consecutive 55 years and now has a yield of 2.5%. The dividend payout ratio stands at around 60%. In 2017, it spent $8.9bn in dividends – i.e. 50% of its free cash flow of $17.8bn. It paid its latest dividend of $0.84 on March 13, 2018. The 5% annual dividend increase for 2017 is low compared to the last eight years (last two annual increases were 6.7% in 2016 and 7.1% in 2015).

Even though J&J is using its cash flow to improve shareholder value, it is also being prudent with the way it manages its finances. Looking at the string of mergers and acquisitions conducted over the past few years, it seems that it would be offsetting these costs by balancing its dividend payout. This could be a reason for a decrease in annual dividend growth. However, all in all, its robust dividend payout despite the future challenges makes it a reliable stock in a prudent investor’s portfolio.

How Does JNJ Stock Compare with the Top Healthcare stocks in the Dow Jones U.S. Health Care Index (DJUSHC)?