Dow Jones Investors: Technical Analysis Strategies in Daytrading

The price-weighted average of the most 30 prominent stocks traded on the New York Stock Exchange (NYSE) and NASDAQ is known as Dow Jones. In general, the stocks with higher market caps are considered in Dow Jones trading and this is important information when we are looking for ways to capitalize on stocks in live markets.

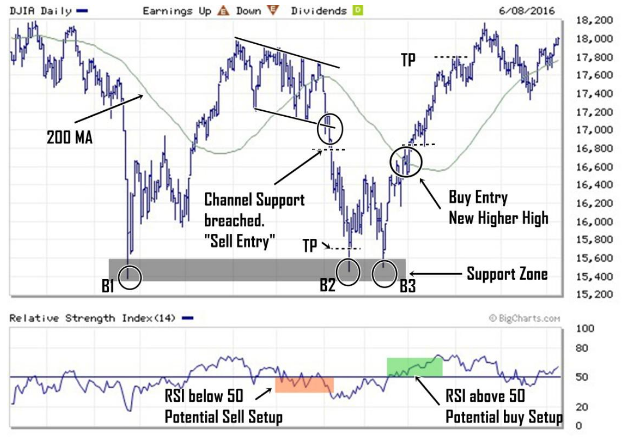

Dow Jones Daily Bar Chart

Figure: Dow Jones Technical analysis strategy

Trading the Dow Jones is pretty effective with RSI and 200-day moving average. Forex moving averages can be found using an effective forex trading platform like the software offered by easyMarkets. Traders draw trend line and channel to find potential trade setup. Unlike another trading strategy Dow Jones is traded with breakout strategy. Traders draw proper channel and trend line in the daily bar chart and wait for confirmation signal in the RSI after the breakout.

Trading Channel Support

In the above figure sell signal was initiated with the breach of channel support. Traders take the confirmation from RSI value. Since a value of RSI was below 50, the sell signal was valid.

The second trade was initiated after successful completion of the triple bottom in the bar chart. Traders went long after the new higher High which was created just above the 200-day moving average. Before going long, make sure that the value of RSI is above 50.Remember that we will go long only if the price is above 200-day moving average and for short the price should be below the 200 days moving average.

Understanding Time Frames

When you are using technical analysis strategies like this, it is always important to consider the time frame you are using in your approach. There are some differences in the ways that markets operate in the short-term and long-term perspectives, and these time frames tend to be most useful for certain types of trading styles. If you tend to have a more conservative approach, then it is usually preferable to adopt a long-term trading strategy as this will allow you to avoid many of the short-term fluctuations in price that can be seen on a short-term day trading basis. These are factors that should be considered before you make the decision to put live funds into the active markets.