Exchange-Traded Funds (ETFs) are investment securities that allow potential investors to trade a market without the risk of owning any stock. ETFs resemble index funds. They enable an investor to buy a collection of securities with a single transaction. ETFs trade any time of the day as their prices keep on fluctuating. Usually, ETFs track particular securities, just like an index.

What Are Bitcoin ETFs?

Every ETF is tied to an underlying index. In the case of Bitcoin ETF, the index would be the Bitcoin or a portfolio of Bitcoin and other cryptos. A Bitcoin ETF will follow the price movement of Bitcoin crypto.

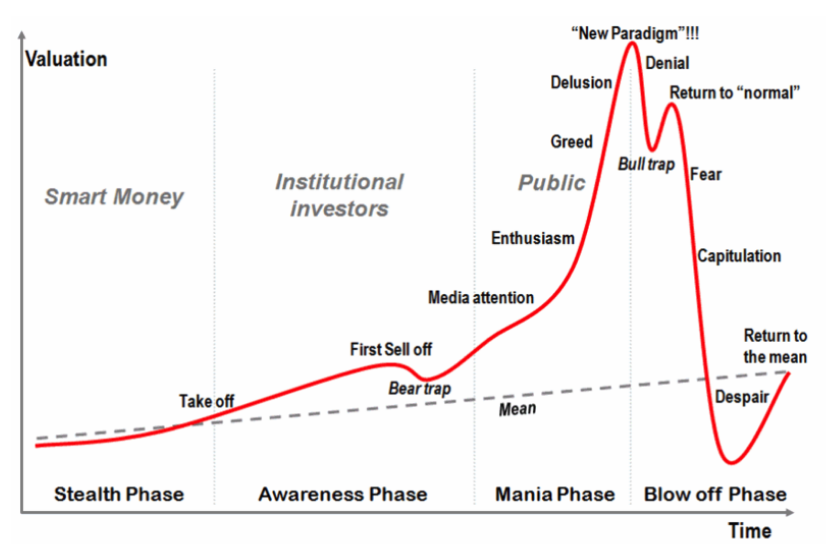

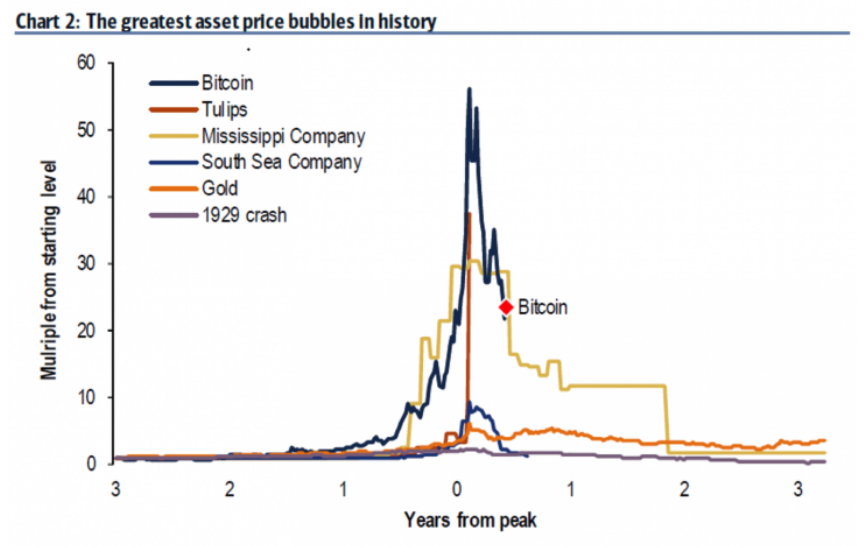

SEC, the US Securities and Exchange Commission classifies ETFs as securities. An investor does not need to own the underlying asset. ETFs are good options in volatile trading markets because they are appropriate in mitigating risks. Trading Bitcoin and other cryptocurrencies have had challenges, especially high volatility and regulation.

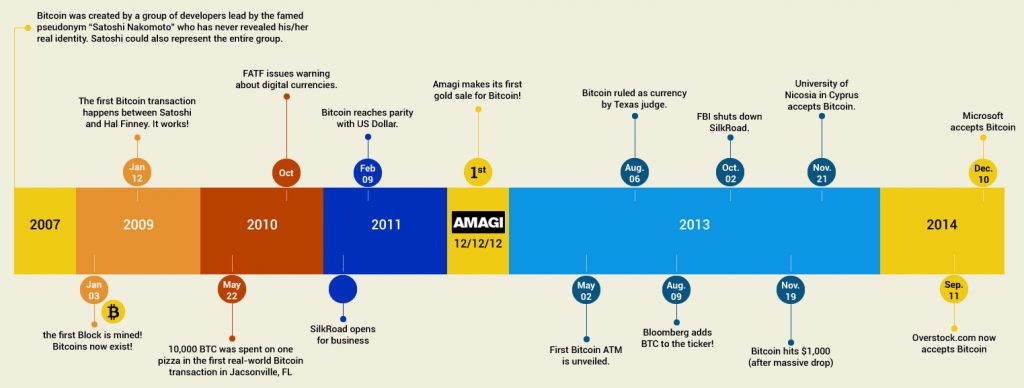

Since its introduction about a decade ago, Bitcoin has grown in popularity, attracting interests from investors and governments. As an investment option, Bitcoin experiences significant and sudden price movements, which has caused skepticism in some sections. The crypto market is still unregulated, which exposes it to manipulation and fraud. Investing in the crypto is not easy for new entrants; at the minimum, one has to set up as an account with an exchange firm.

A Bitcoin ETF will possibility address all these challenges. It will offer investors an opportunity to profit from a secure, familiar, and regulated environment. An ETF will add some element of security as investors’ money will be tied to the price and not the digital coin.

Bitcoin ETF Approval Attempts

ETFs are in the securities class; as such, SEC has regulatory authority over them. Before 2019, SEC had rejected several applications for Bitcoin ETFs to operate at the New York Stock Exchange.

In October 2019, SEC rejected an application for a Bitcoin ETF from Bitwise Asset Management. In its rejection notes, the regulator cited a high probability of manipulation and fraud as the main reasons for the denial. SEC seems not to have a problem with the Bitcoin ETFs as a product; the concern is with the underlying asset.

In mid-November 2019, SEC announced it would be reviewing its October decision to reject Bitwise Asset Management’s ETF application. In its advertisement for review, the regulatory body stated that it would be opening the request for comments. It has given a one month period for evaluation. However, the rejection order it issued in October is still in force.

Bitwise Asset Management made its application at the beginning of this year. The request relied on extensive data research. Bitwise remains hopeful and is considering adopting the research route again in its re-submission.

This November, Kryptoin Investment Advisors, a firm based in Delaware, has filed an initial registration statement with SEC. The ETF has been in development for two years and will track the Bitcoin reference rate. T A former executive director of the World Gold Council spearheads the Kryptoin’s EFT application. The former director believes that the challenges that Bitcoin is facing as a class asset as similar to what the world gold council experienced when it introduced SPDR Gold Shares to the market.

The market is waiting for the first approved Bitcoin EFT. There is optimism that EFTs will eliminate the issues with Bitcoin and the altcoins. SEC is not convinced that Bitcoin is free from manipulation, but with all the interest from different experts, it’s only a matter of time.