Why should investors want to know about the history of gold prices?

As a financial investor buying and selling commodities, it is important to understand the market’s underlying trends. Knowing about the history of gold prices will also help investors make better financial decisions — not only in commodities but other markets, as well.

It is important to know more about the history of your business and the industry in which it operates. Over time, these types of practices can help to shed light on how you should invest and when certain mistakes can be avoided.

Gold’s history as a safe-haven asset

In gold, you will know why the prices change the way they changed, which is why investors should consider buying some of the best gold coin inventory. You also know about the high and the low season.

Gold is seen as the most precious metal among the others. Its value is mostly higher than the others. Today, gold is still used as a reliable way to store wealth and this will continue to be the case because of the changing values of fiat and paper currencies.

Gold prices can change but they have historically remained at a reasonable level of value. Therefore, gold is still the best measure of wealth for investors.

History of financial markets

This is a continuation of the traditional norms, as kings and queens have always stored their wealth in the form of gold. Many decades ago, gold was used as money on an everyday basis.

Our forefathers traded products for gold and remnants of these trends still exist today. In some nations, gold is used in making coins (though in small amount, but it is of great value.)

In some museums, you will find a collection of these coins that were fully or partially made of gold. The prices of gold have however faced changes in the recent years.

Today, gold is traded in electronic trading platforms. In 2011, it managed to rise up to over $1900 before it started declining, and this shows just how much gold is still valued in society. Gold is making headlines not only in physical form but also virtually as a basis for many cryptocurrencies.

History of gold prices in the United States

Starting in the year 1791, the prices of gold in the U.S experienced changes. In this year, the price of gold was $19.49 per ounce. 43 years down the line, the price went up to $20.69 per ounce (increasing by just $1.20 after 43 years).

In 1928, the Federal Reserve raised its base interest rate levels, which ended in a recession in 1929. These events inspired many people to redeem the normal currency and exchange fiat into gold. This is largely why gold has more value compared to the U.S. dollar at this time.

Due to the high demand for gold, the Federal Reserve was asked to raise the interest rates. In 1931 the value of the dollar increased and there was a decrease in demand for gold. In 1933, a law was stated that did not allow anyone to own bullion and gold coins.

Ever since then, the history of gold prices in the U.S became more interesting for bullish investors. The strength and weakness of the dollar has contributed to the increasingy bullish price changes for gold. Before investing in gold, you should be aware of factors that contribute in change of price in gold.

Our analysts will enable you know the best time to invest and when to avoid such markets. As a result, there are many factors that have contributed to the change of price in gold over time.

Demand and supply of physical gold

Gold has many uses from making jewelry to being used as a store for wealth. When gold is in high demand and the supply is low, the prices tend to go up. This is one cause of changes in gold prices. It is not different from the other markets.

Any product that has low supply compared to demand increases in price. When gold is in high supply and the demand is low, prices go down. This is because sellers has more than what the market needs.

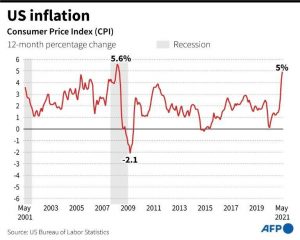

Inflation and deflation

This is a sign that the economy is growing. Higher rate of inflation leads to higher prices of gold. Inflation is as a result of stable political factors and motivation in economic growth.

For instance, gold did not perform well during the world war. Before the beginning of World War 1, some nations adopted the Gold Standard, which was used to compare domestic currencies (before setting the prices) to the value of a certain amount of gold.

However, this came to an end when the war begun. During this period, economic growth was not experienced either. Deflation happens when there is no upward growth in the economy. It is a time when there is less employment opportunities and investments. This leads to decrease in gold prices.

Central banks

Central banks are in charge of the amount of money circulating in a country. It also has the mandate to limit the amount of gold in supply. This can lead to change in prices.

Another factor to remember is that when the central bank increases interest rates, the price of gold rises. Central banks therefore play a vital role in changes of gold prices.

Strength and weakness of the U.S. dollar

These days, Gold is denominated in U.S. dollars. When the value of the dollar goes high, the price of gold decreases. It is also true that gold price increases with a weakening dollar value.

Of course, this is because when the dollar becomes weak, the currency in other nations become stronger. When this happens, the demand for products go up, gold is one of them. Its demand goes high leading to raise in its price.

Conclusion: gold’s long history in financial markets

The history of gold prices starts way back during the B.C era. It was highly valued like today. As time went by, gold coins were used instead of gold bars. Today, gold remains to be a treasure.

If you have gold, you feel that you are rich. This is because of the value it has and how much it is worth. A small piece of gold will go for dollars. Most importantly, people in the buying and selling of gold should not overlook its journey.