Dividend Stocks: Exxon Mobil Trading Near Long-term Lows

Exxon Mobil Corp. (NYSE: XOM) is an energy company that was incorporated in 1882 and is headquartered in Irving, Texas. The company’s business involved the exploration, production, and distribution of oil, gas, and petroleum products. The company classifies its business into the following segments Upstream, Downstream, and Chemical. The company has multiple locations across the globe, and its expansive reach makes Exxon Mobil one of the most influential companies in the world.

Many investors trading CFDs are able to implement long-term strategies when dealing with stocks related to the energy market — and this includes assets like XOM and the United States Oil Fund (NYSEARCA:USO).

XOM: Recent Company News

In the latest company developments at Exxon Mobil, the US Department of Justice announced a $15 million settlement to clean up contamination at Sauget Area 1 sites in Illinois. On February 10th, Pason Systems was awarded a global license for ExxonMobil’s patented drilling advisory system. On February 6th, Exxon Mobil clarified that impact will be minimal from the flaring incident at the Baytown, Texas refinery capacity.

Corporate Earnings Results

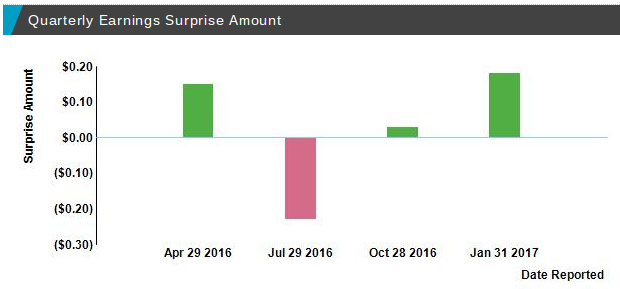

On January 31st, ExxonMobil reported its Q4 earnings. XOM Q4 revenues came in at $61.016 billion, compared to $59.807 billion same quarter a year ago. Its Q4 earnings-per-share were $0.41, compare to $0.67 during the same quarter a year ago. Thomson Reuters surveys showed that Q4 expectations were $62.282 billion in revenues, while Q4 adjusted earnings-per-share were $0.70.

Currently, analysts are expecting earnings-per-share of $4.14, and sales $304.427 billion for the year ending December 2017. Quarterly natural gas production was 10.4 billion cubic feet per day, declining from last year’s numbers by 179 million cubic feet per day. Similarly, its quarterly liquids production dropped by 97,000 barrels per day (to 2.4 million barrels per day).

XOM Stock Prices

The XOM stock price is trading around $81 almost, near where it was one year ago. During the past year, the stock made lows of $79 in February and highs of $95 in July. It’s trailing-twelve-month earnings-per-share is $1.88 and at the current stock price, XOM’s P/E ratio is 43.57x (compared to industry average of 35.51x as per Reuters).

The company is a regular dividend payer, paying a quarterly dividend of $0.75. This equates to a yield of 3.67%, which is much better than the industry average of 1.69% as per Reuters. It has a payout ratio for the trailing-twelve-month period of 118.88%

Lately, the sector has been bleeding due to depressed crude oil prices, and this has caused XOM’s sales during last year’s to drop by -14.74%. We can compare this to a year ago when the company’s profits shrank by -51.22% for the same period. Due to the dim outlook, some analysts are recommending to hold the stock, as the Reuters’s census recommendations currently classify the stock in this way.