As Consumers Move toward Healthier Beverages, The Coca-Cola Company Struggles to up the Ante

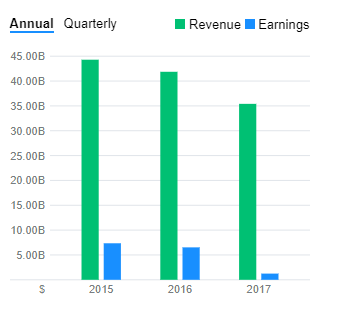

Coca-Cola Company (NYSE: KO), the premier multinational beverages company has found itself struggling with maintaining its revenue growth. Due to ongoing re-franchising of its bottling territories, its net revenue ($7.5bn) declined by 20% in Q4 2017 and by 15% for full-year 2017. It earned 39 cents per share for the same period. However, for Q4 it beat analyst estimates who predicted revenue of $7.37bn and an EPS of 38 cents. Cash flow from operations stood at $7.0 billion (down 20%) while $3.7bn worth of shares were repurchased for the treasury.

Coca-Cola posted better than expected fourth quarter results with organic growth of 6% from the year-ago period and 3% growth for the full year period. This momentum is encouraging for the investors considering the fact that the overall non-alcoholic beverage industry was down in 2017. It also expanded its product portfolio by entering the ready-to-drink coffee category in the US and shifted two local US brands (Honest and Smartwater) to international markets. Expansion of portfolio resulted in stronger revenue growth, for e.g. 5% growth in the EMEA operating segment.

What are some recent developments that would rake in shareholder value?

- Coca-Cola announced a new initiative called ‘World Without Waste’ in January 2018, under which it announced new sustainable packaging goals that focuses on its package design to ensure its products are 100% recyclable.

- To accelerate the consumer-centric portfolio, it expanded its ‘Venturing and Emerging Brands’ initiative to Central and Eastern Europe.

- It has planned to reduce its gross debt level by $7bn with its overseas cash which will now be repatriated in line with the tax reform act (which led to a one-time charge of $3.6bn in Q4 2017)

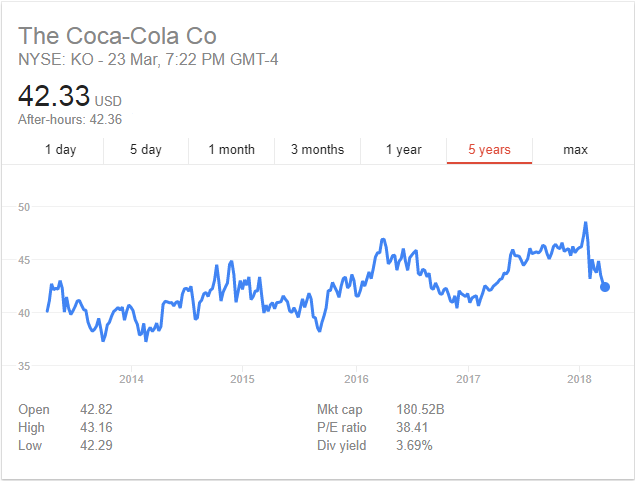

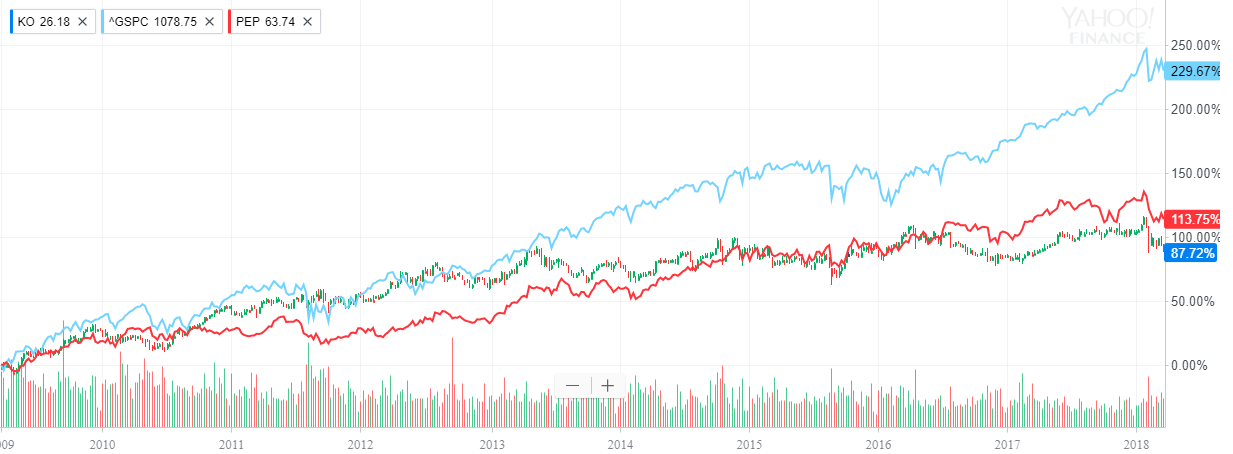

The Coca-Cola stock is trading at a flat 0.5% YTD as on 24th March 2018.Compared to PepsiCo and S&P 500, Coca-Cola’s stock growth was low at 9%. This was primarily due to constant decline in the net revenue for the past 10 quarters. In Q4 2017, the net sales dropped by 20%.

A noticeable drop of ~20% can be seen in May 2016 during the time when the company restructured its ownership by merging with its European peers. However, this was a temporary blip as the shares went up by 13% in the next six months.

Compared with its rival, PepsiCo, Coca-Cola has been able to drive more earnings to its bottom line. Even though Coca-Cola net revenue has been declining, it has higher margins of 15-18% compared with PepsiCo’s 10%. On the dividend side, however, PepsiCo has posted an average of 10%, while Coca-Cola has an increase of 8.5%. Both the companies have dividend yield much higher than the S&P 500 index.

A Dividend King

In 2017, Coca-Cola boosted its annual dividend by 5.4% (from $1.48 to $1.56). Its current quarterly dividend amount of $0.39 yields 3.69% with a payout ratio of 74.6%. In 2017, it paid $6.3bn in dividends and $2bn through share buyback. For 2018, it has planned to return $6.7bn in dividends and $1bn in share-buyback.

As the biggest beverage company in the world with a market cap of $184bn, Coca-Cola has also established itself as a Dividend King (and a Dividend Aristocrat) by annually raising its dividend for more than 50 years. Even though the growth rate has come down in the recent years due to headwinds in the beverages industry, Coca-Cola remains an attractive stock for prudent and discreet investors.