Stocks Strategies: Brookfield Real Assets (RA) Offers Value in Elevated Markets

In December, Brookfield Investment Management (NYSE: RA) announced its decision to merge three legacy funds (Brookfield Mortgage Opportunity Income Fund Inc, Brookfield High Income Fund Inc., and the Brookfield Total Return Fund Inc.) These funds became the Brookfield Real Assets Income Fund (the Fund) on Dec 5th, 2016. The Fund has an annualized distribution rate of 10.3% as of March 2, 2017.

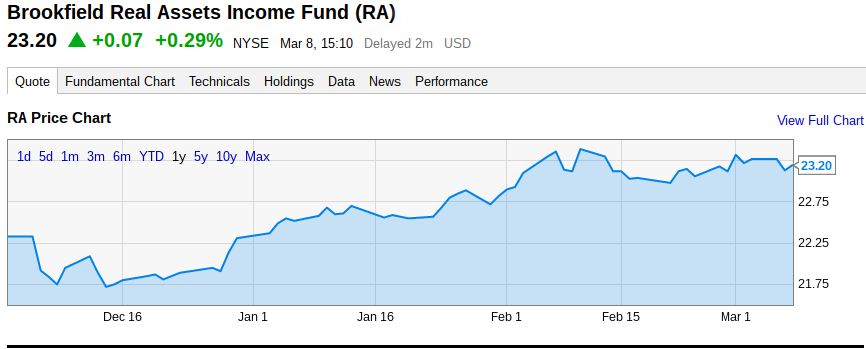

In the chart above, we can see that the recent strategy changes at Brookfield have been viewed positively by the market, with significant rallies already posted this year. This means that stocks like RA should be on the radar for any investor looking for sustainable value in an environment where stock benchmarks like the S&P 500 and the Dow Jones Industrials are trading at overextended levels.

Recent Updates

In the Q4 update, Brookfield stated that the objectives of the reorganization were threefold. Merging the fund would provide a larger scale through trading liquidity for shareholders and broaden market interest. In this way, it is clear that Brookfield still sees opportunities for greater income and growth. Additionally, merging the funds has allowed income levels to stabilize and this should lead to less volatility during market cycles.

Strategically, this closed-end investment instrument looks to provide high total return using two approaches. Primarily, the Fund looks for high current income opportunities and, secondly, it looks for growth of capital. As its name suggests, the Fund looks to invest in so-called “real assets” such as real estate securities, infrastructure, and natural resources.

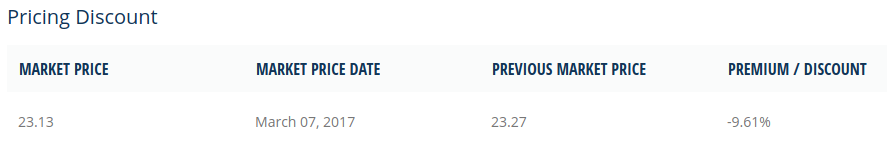

Those three industries comprise more than 97% of the Fund’s total investments. The Fund’s NAV is currently more than $25 and this number has increased by more than 3% since its December inception. The stock trades at a NAV discount that is something of a rarity when we look at the elevated nature of stock prices in general.

Stock Market Optimism

So far in 2017, the Trump victory has supported analyst expectations for higher economic growth within this US-focused fund. The stock has clear potential for growth as Trump’s pro-business agenda will likely lead to continued improvement in the nation’s housing market fundamentals.

As a whole, investors have in bullish fashion as Brookfield is already well-positioned in a somewhat overlooked industry that still has potential to grow over the next few years. Notably, the Fund’s investment in hotels, health, telecom, and oil and gas transportation has been positively received as an added volatility safeguard. But even with the significant price rallies already seen this year, the stock still trades at a NAV discount of nearly 10%:

As 2017 continues, the outlook remains favorable. Streamlining regulations, tax reforms, and growing infrastructure spending policies should continue to support the assets that make up Brookfield’s portfolio. Of course, as U.S. policy becomes more clear over the next few months it should be noted that there is some inherent risk if broader market surprises are seen.

For example, inflation may continue to rise as energy prices stabilize. The Fund management believes the general improvement of the US economy should tighten credit spreads and increase equity prices, however. If this turns out to be the case, RA should be able to extend in its rallies and gain more of the market’s attention in the process.

For more information, visit Pristine Advisers for a free investor relations consultation.