BAC: Bank of America Trades Near Inflection Point

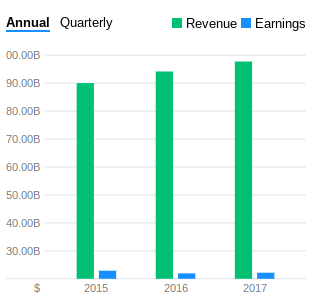

Throughout nine months which has been brought to an end on 30 September, Bank of America (BAC) has generated net income by 162.16% to $7.17B. The net income has increased by 6.43% to $7.18B. On top of all of that, the company has $184.86B worth of cash and due from banks, 8 times higher than from the cash & due from banks of its no.1 competitor which is J.P. Morgan Chase & Co (JPM).

Bank of America is with Wells Fargo having the better current ratio and quick ratio among the top four money center banks as compared to J.P. Morgan Chase and Citigroup. The current ratio and quick ratio of the company evidently manifested the firm capability of the company to shoulder all their debts. As having total assets of $2,338.83B and the current ratio of 11.82, the company will surely be secured from its debts to the upcoming quarters.

In addition to that, Bank of America has achieved a gearing ratio of 1.59. Therefore, the firm’s management will be funded by the equity capital against the creditor financing and highly leveraged because it is higher than 50%.

Key financials

The target price/current last sale’s percent of the target price is $ 52 / 208%, which means the firm had achieved as twice as its aim price as well as it also endured its competitors to this point. The company’s earnings per share have an amount of $8.07.

This is a clear manifestation of the company’s strong profitability which will continue in the future due to their effective operation. Furthermore, we can say that investors can expect to earn more because the price-earnings ratio is $13.43.

| Bank of America | JPMorgan Chase | Wells Fargo | Citigroup | |

| Total Cash & Due from Banks | 184.86B | 23.23B | 18.79B | 25.727B |

| Total Debt | 417.35B | 516.37B | 326.77B | 444.93B |

| Other Earning Asset | 972.52B | 105.45B | 779.231B | 1057.52B |

| Debt to Equity | 159.20% | 199.40% | 164.42% | 225.85% |

| Total Short-Term Debt | 200.64B | 246.24B | 105.45B | 209.68B |

| Current Port. of LT Debt/Capital Leases | 4.88B | – | – | – |

| Total Long-Term Debt | 211.84B | 270.12B | 221.32B | 235.26B |

| Current Ratio(Industry) | 11.82 | 0.69 | 11.82 | 1.69 |

| Quick Ratio(Industry) | 11.77 | 1.69 | 11.77 | 0.69 |

| Return on Equity | 9.73% | 12.84% | 10.39% | 8.46% |

| Debt Ratio | 0.89 | 0.90 | 0.89 | 0.90 |

| Working Capital | 262.16B | 258.96B | 198.741 | 197B |

| Return of Asset | 1.10% | 1.22% | 1.29% | 0.92% |

The 28 forecasters proposing 12-month price forecasts for Bank of America Corp have a median target of 34.75, with a high approximation of 40.00 and a low estimate of $28.00. The median estimate shows a +24.60% growth from the previous price of $27.89.

The recent consent from 30 polled investment forecasters is to buy stock in Bank of America Corp. This assessment has held steady since October when it was unaltered from a buy rating.

Biggest Quarterly Profit in Bank of America’s History

Bank of America has made everyone in awe once more as it pulled out a profit worth $6.9 Billion after 3 quarters of 2018, as it had overcome its personal best attained during 2011.

After compensating $1.5 Billion to President Trump as income tax which is 26% earlier, the company has still envisioned its upcoming success. The company has been advantageous with the law reforms regarding taxes from the rate of 30% plummeted down to 26%. As a result, it has become exultant with the pretax income risen up to 15% whereas revenues up to 4%.

Technological Investment of $500 Million for Innovation and Sales

As Bank of America shut down its branches to different locations and closed its doors to its employees, it has still found and developed ways to reach out for its beloved customers as it enhances the services through technological advancement. Bank of America proposed to open over 500 new US bank branches in the next four years which will cover 88% GDP. Modifications in terms of technology and interior aesthetics will happen with over 1,500 branches and 5,400 certified financial planners will aid the support in the long run.

Final verdict

As the Bank of America has exceeded the expectations by boosting 9% rise in its consumer loan business, reported fourth-quarter earnings of 2017, the corporation could not be contented with the positive response. Even though the year has been good to Bank of America, we could still give them an affirmative assessment and rate “buy” as well.