Mexico Fund: Stable Exposure To LATAM Emerging Markets

The Mexico Fund (NYSE:MXF) is a closed-end fund designed with the investment objective of providing long-term capital appreciation through strategic portfolio allocations in the markets. Incorporated in June 1981, and domiciled in the U.S., has always been managed by Impulsora del Fondo Mexico S.C. The fund offers well-positioned access to Mexico’s economy through a broad range of public listed companies.

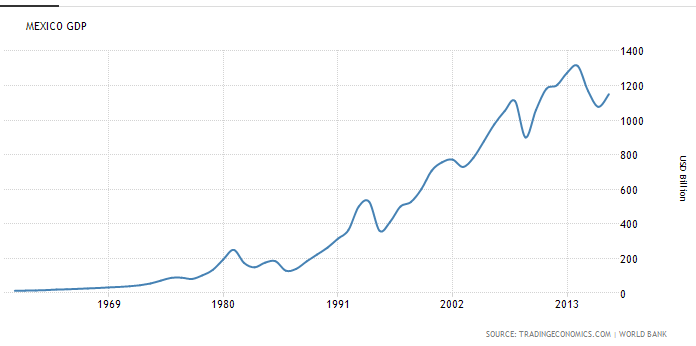

Economic Trends in Mexico

Since MXF mainly offers exposure to equities securities listed on the Mexican Stock Exchange, the economy of Mexico has a substantial impact on the fund. However, several of these companies now earn a significant portion of its income and profits abroad, through exports and subsidiaries in other countries or regions. Broadly speaking, the macro trends look highly encouraging.

Source: World Bank / Trading Economics

In 2017, the economy of Mexico grew at a rate of 2%, while in the first half of 2018 the pace maintain the 2% rate. Analyst surveys at the Mexican Central Bank predict sustained full-year expansion of 2.3% and 2.2% for 2018 and 2019, respectively.

Political uncertainty due to Presidential elections held on July 1st 2018, and the significant volatility seen in the global stock exchanges earlier this year had a visible impact on the share prices of MXF. Share prices reached its yearly low on June, however, the stock has posted a sharp bullish reversal, and this suggests that a long-term bottom is likely in place for the stock.

The prior negative trends in the stock price can be attributed to strong movements in the global environment. Some of the major events that have impacting the MXF fund during this period:

- Sharp decrease in oil and other commodity prices staring on 2014.

- Political environment in the U.S.

- Pending resolution of NAFTA renegotiations.

- Political uncertainty in Mexico due to Presidential elections.

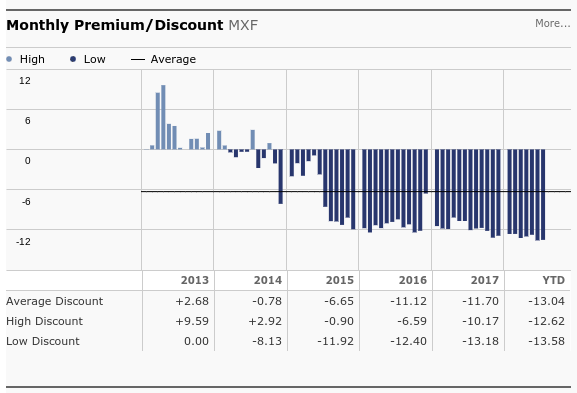

Finding Opportunities At Lower Valuations

Macro trends over the last few years have not been favorable for regional assets. But these declines have created significant opportunities for investors. When viewing the closed-end fund through the lens of its discount to net asset value (NAV), we can see that the Mexico Fund is now trading at some of the deepest discounts in its recent history.

Source: Morningstar

On June 12, 2018, the Board announced a dividend of $0.15 per share to its investors. This represents an annualized dividend of $0.60 per share, and an accompanying dividend yield of 3.63%. The quarterly dividend was increased from $0.13 per share to $0.15 per share in April 2018, representing an increase of 15.38%.

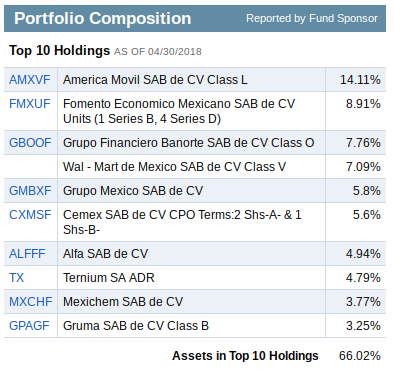

Source: Fidelity

Source: Fidelity

During the first seven months of 2018, the Mexico Fund has had a productive year, with a positive NAV total return of 8.78%, while outperformed its benchmark (the MSCI Mexico Index) by 250 basis points. As of July 31, 2018, the fund’s market price was $16.63 and its NAV per share was $19.23. The Fund has outperformed its benchmark during the last one, three, five and ten year periods ended on July 31, 2018.

Positive Improvements in Share Prices

During the May-June period this year, the broader market experienced the broader ramifications of the ongoing trade-war tussle between the U.S. and China. The Mexico Fund saw a nice rebound following this period, however, and the stock correction generated gains of 13% through mid-July. This creates a more positive outlook for the remainder of 2018, as trade war fears have subsided, global trade exchanges have resumed their previous rallies and an improved political environment.

Fund Exposure

Changes in fund holdings in the first half of 2018 have created additional positives, as exposure in the domestic consumption sector was reduced in favor of increases in exposure to the financial services sector. Widespread gains have been seen in financial stocks over the last year, and this puts the Mexico Fund in a much better to capitalize on those trends going forward.

The rising cost of raw materials and high relative valuations have impacted the profitability of companies in the domestic consumption sector, while the financial services sector is still showing higher projected margins. All together, this bodes well for the outlook and sets the Mexico Fund on a course to close its NAV discount heading into next year.