Equus Total Return Offers Opportunities in Small-Cap Stocks

Stock markets continue to push higher after the volatile and problematic trading activity earlier this year. The S&P 500 is breaking to new highs above 2800 and investors looking for value have found it increasingly difficult to locate stable stock opportunities that are still trading at favorable valuations. But one area that should continue to be on the radar for investors is the small-cap space, as there are many excellent pockets which be found in key industry sectors.

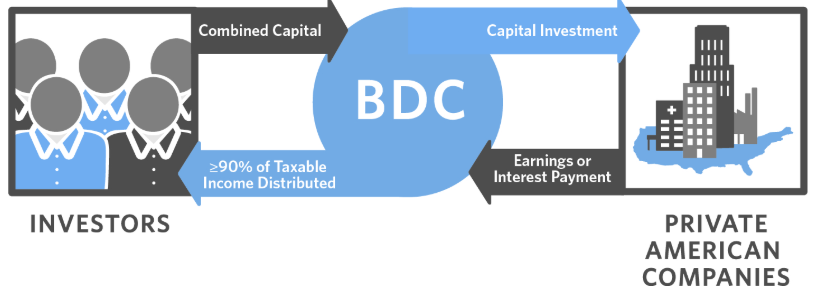

One key stock selection is Equus Total Return, Inc. (NYSE: EQS), a business development company (BDC) which was formed with the aim of generating superior overall returns through current income and capital appreciation investment strategies. This objective is accomplished by investing in equity and debt securities in companies with a total enterprise value of between $5 million and $75 million. As a BDC, Equus is required to invest 70% of its assets in private and small public U.S. companies.

In addition, Equus qualifies as a Regulated Investment Company (RIC) under the Internal Revenue Code and does not pay corporate income taxes, so the combination of these factors brings stability and cost-value for sustainable growth positioning in the market.

Assessing the Market Outlook

In March 2018, the U.S. Federal Reserve raised its benchmark interest rate (by 0.25%, to a target range of 1.5% to 1.75%). This decision was accompanied by an announcement of at least two more planned rate hikes before the end of the year. This shift in monetary policy has prompted the Equus board to review its investment strategies and seek opportunities for liquidity in certain aspects of its portfolio as a means of enhancing shareholder value.

Undeniably, global economic events have had an impact on Equus shares and on the stock market as a whole. The 2015-16 equities sell-off, promulgated by Greece’s default on its debt securities, the collapse of oil prices, and an overall downturn in the broader economy, led to rising volatility on Wall Street. But when we view the broader trend activity in the stock, we can see that Equus held up surprisingly well under the circumstances.

As this occurred, the price of Equus shares declined by roughly 30% (from its high of $2.45 in January 2014 to $1.50 in March 2016). The stock then rose by 90% in May 2018 before giving back some of those gains again in June of the same year. This latest round of macro volatility was brought about by the ongoing trade war discussions between the U.S., China, and the Eurozone.

Equus: Assessing the Financial Metrics

When assessing the financial metrics, several key positives can be seen. Revenues for 2017 came in at $3.7 million, which was a gain of more than 400% on an annualized basis. These achievements were due, in large part, to the strong performance of its portfolio company MVC Capital. Operating cash flows stood at $10.0 million, and those performances may have been even more impressive if the planned merger with U.S. Gas & Electric had reached completion.

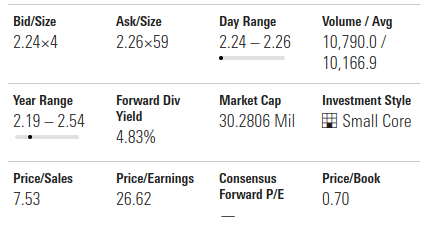

Looking ahead, these positives are flashing potential ‘buy’ signals for investors based on the growing likelihood the Equus stock will see a narrowing in its discount to its net asset value (NAV). With its current share price of $2.28, the stock’s P/E ratio has fallen more in line with the averages seen for the financial services sector (now at 19.70).

Equus Portfolio Positioning

Looking at specific portfolio positioning, the fair value of its holdings in Equus Energy have increased from $6.3 million to $8.0 million, due to the positive developments in economic conditions that impacted mineral rights owned by the company. With ownership of about 144 producing and non-producing oil wells, Equus Energy has a strong outlook for further development.

During 2017, the fair value of Equus’ share interest in PalletOne increased from $16.2 million to $16.7 million, due to overall improvements in the wood products and packaging industry, as well as the specific financial performance of PalletOne during the year. PalletOne is the largest wooden pallet manufacturer in the U.S. EQS holds an 18.7% equity share in this key industry asset.

Lastly, the fair value of Equus’ share interest in MVC Capital increased from $4.0 million to $5.2 million. The trading price of MVC’s common stock rose from $8.58 per share in 2016, to $10.56 per share in 2017. MVC also paid Equus a dividend of 27,600 shares during this period. This increase in the MVC share price and dividend payouts helped improve the relative position of Equus’ portfolio holdings – and this helps brighten the outlook for investors.

Bouncing Back from Merger Obstacles

The Equus trading price suffered a hit after the merger agreement with U.S. Gas & Electric was terminated in May 2017. The merger was designed as a stepping stone in its reorganization plans, but the initial declines quickly corrected it in the days that followed. A termination fee of $2.5 million received by Equus has positively impacted the company’s available cash balance, and any resulting declines in stock prices are now being viewed as new buying opportunities.

Overall, it is clear investor sentiment has turned positive for Equus. Elevated valuations in the S&P 500 suggest that investors should be looking to small-caps (and at closed-end funds, in particular) when seeking value in this context. The stock’s attractive NAV discount and solid positioning within the industry suggest we will probably see further gains in share prices. For patient investors, Equus has shown the ability to streamline its portfolio exposure in ways that are expected to benefit shareholders in the quarters ahead.