Since its inception in 1849, Pfizer, Inc. (NYSE: PFE) has introduced game-changing medicines in the market. In the past few years, the pharmaceutical giant has garnered confidence amongst shareholders and prospective investors by delivering a string of robust medicines which have contributed to its annual revenue. In Q4 2017, Pfizer’s Eliquis raked in $170m in revenue which was 46% higher than the year-ago figure, while Chantix-Champix contributed $271m in revenue which was 28% higher than the year-ago figure.

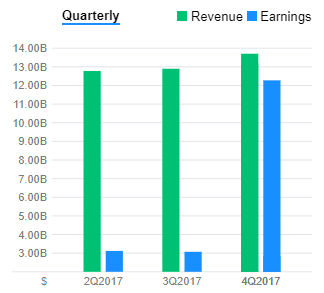

Pfizer had a satisfactory result in 2017 when it posted gains of 2% (y-o-y) in its revenue for Q4 2017 ($13.7bn) and Year-end 2017 ($52.5bn). Its diluted Q4 EPS of 62 cents beat Wall Street estimates of 56 cents per share. Compared to Q4 2016, Pfizer’s Innovative Health unit, which contributes 60% of the revenue, grew by 6% in Q4 2017 ($8.2bn); while Essential Health segment, which contributes the remaining 40%, declined by 7% in Q4 2017 ($5.5bn). Its overall revenue was negatively impacted by $2bn as it lost marketing exclusivity rights for some of its drugs like Enbrel, Pristiq, Viagra, Lyrica, and Vfend.

With the passage of the new tax reform act, Pfizer expects a $15bn tax bill over eight years (effective tax rate of 17%) and plans to invest approximately $5.6bn in capital projects, employee bonuses, and pension plans. Considering that it also has a strong portfolio of robust growth drugs, shareholders can remain bullish on Pfizer stock.

Pfizer’s stock has experienced ups and downs during the past decade due to the loss of patent exclusivity of some of its top-selling drugs. In 2012, the sales dropped by 10% when it lost the patent battle for Lipitor, the cholesterol fighter drug. This also led to underperformance in terms of market share, revenue and net income growth. However, in recent years the company has benefitted from its targeted acquisitions, namely,

- Acquisition of the development and commercialization rights of the EU drug Zavicefta™, Merrem™/Meronem™ and Zinforo™ from AstraZeneca in December 2016 for $1,045m

- Acquisition of Medivation in September 2016 for $14.3bn

- Acquisition of Anacor in June 2016 for $4.9bn

- Acquisition of Hospira in September 2015 for $16.1bn

In 2017, the stock grew roughly by 17% due to gains in its robust drug pipeline. If the 2018 guidance is followed through, we can safely predict stocks to reach $40 by the third quarter of 2018.

Why should you choose to stay with Pfizer stock?

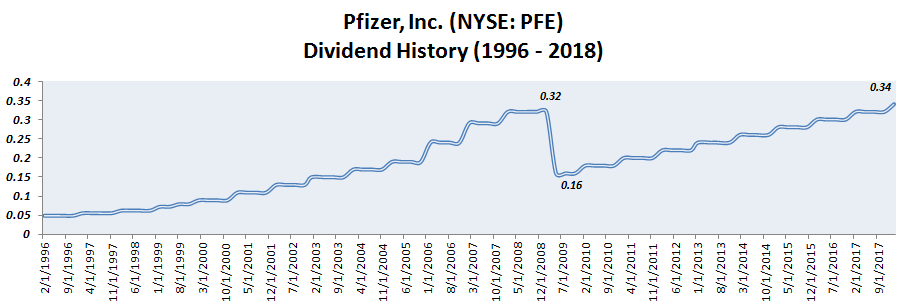

Pfizer’s dividend is the primary reason. Its current dividend yield of 3.7% is above the industry’s average of 3.2% and the S&P’s 2.0%. In its recent announcement, Pfizer increased the dividend by 6% (from $0.32 to $0.34 paid on March 1, 2018) which marks the 317th quarterly dividend paid by the company. In addition to this, it has increased it in the past nine consecutive years.

For fiscal 2017, it reported free cash flows of $14.25 billion. $7.66 billion was paid as dividends and $5bn as share buybacks which means that Pfizer at present has a free cash flow dividend payout ratio of around 53%. The broad pipeline of products under its umbrella and its strong dividend payment are reasons for investors to consider Pfizer as a reliable stock.